Standard Deduction For 2020 . There is an additional standard deduction of $1,300 for. The standard deduction reduces a taxpayer’s taxable income. here are the 2020 standard deductions amounts for each filing status: 10% tax rate up to $9,875 for singles, up to $19,750 for joint filers, 12% tax rate up to $40,125. the 2020 federal income tax brackets on ordinary income: the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. for single taxpayers and married individuals filing separately, the standard deduction rises to $12,400 in for 2020, up $200, and. It ensures that only households with income above certain thresholds will owe any. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.

from standard-deduction.com

for single taxpayers and married individuals filing separately, the standard deduction rises to $12,400 in for 2020, up $200, and. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. the 2020 federal income tax brackets on ordinary income: 10% tax rate up to $9,875 for singles, up to $19,750 for joint filers, 12% tax rate up to $40,125. There is an additional standard deduction of $1,300 for. here are the 2020 standard deductions amounts for each filing status: The standard deduction reduces a taxpayer’s taxable income. It ensures that only households with income above certain thresholds will owe any. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or.

Can You Claim Standard Deduction And Itemized/page/2 Standard

Standard Deduction For 2020 the 2020 federal income tax brackets on ordinary income: The standard deduction reduces a taxpayer’s taxable income. here are the 2020 standard deductions amounts for each filing status: There is an additional standard deduction of $1,300 for. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. 10% tax rate up to $9,875 for singles, up to $19,750 for joint filers, 12% tax rate up to $40,125. the 2020 federal income tax brackets on ordinary income: the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. for single taxpayers and married individuals filing separately, the standard deduction rises to $12,400 in for 2020, up $200, and. It ensures that only households with income above certain thresholds will owe any.

From dxofytgyl.blob.core.windows.net

Standard Deduction 2021 Joint at Douglas Kempf blog Standard Deduction For 2020 10% tax rate up to $9,875 for singles, up to $19,750 for joint filers, 12% tax rate up to $40,125. The standard deduction reduces a taxpayer’s taxable income. the 2020 federal income tax brackets on ordinary income: It ensures that only households with income above certain thresholds will owe any. There is an additional standard deduction of $1,300 for.. Standard Deduction For 2020.

From www.taxdefensenetwork.com

Standard Deduction or Itemized Deductions Tax Defense Network Standard Deduction For 2020 the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. the 2020 federal income tax brackets on ordinary income: The standard deduction reduces a taxpayer’s taxable income. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard. Standard Deduction For 2020.

From standard-deduction.com

Standard Deduction 2020 For Dependents Standard Deduction 2021 Standard Deduction For 2020 here are the 2020 standard deductions amounts for each filing status: There is an additional standard deduction of $1,300 for. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the 2020 federal income tax brackets on ordinary income: for single taxpayers and married individuals filing separately, the. Standard Deduction For 2020.

From standard-deduction.com

Standard Deduction 2020 Age 65 Standard Deduction 2021 Standard Deduction For 2020 the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. 10% tax rate up to $9,875 for singles, up to $19,750 for joint filers, 12% tax rate up to $40,125. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. . Standard Deduction For 2020.

From blog.churchillmortgage.com

What to Expect When Filing Your Taxes This Year Standard Deduction For 2020 the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. for single taxpayers and married individuals filing separately, the standard deduction rises to $12,400 in for 2020, up $200, and.. Standard Deduction For 2020.

From standard-deduction.com

Standard Deduction 2020 65+ Standard Deduction 2021 Standard Deduction For 2020 the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. The standard deduction reduces a taxpayer’s taxable income. the 2020 federal income tax brackets on ordinary income: There is an additional standard deduction of $1,300 for. the standard deduction is the amount taxpayers can subtract from their income. Standard Deduction For 2020.

From www.pinterest.com

Standard Deduction 2020 Standard Deduction For 2020 There is an additional standard deduction of $1,300 for. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. the 2020 federal income tax brackets on ordinary income: the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. The standard. Standard Deduction For 2020.

From www.forbes.com

The Standard Deduction Is Rising For 2020 Here’s What You Need To Know Standard Deduction For 2020 the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. 10% tax rate up to $9,875 for singles, up to $19,750 for joint filers, 12% tax rate up to $40,125. the. Standard Deduction For 2020.

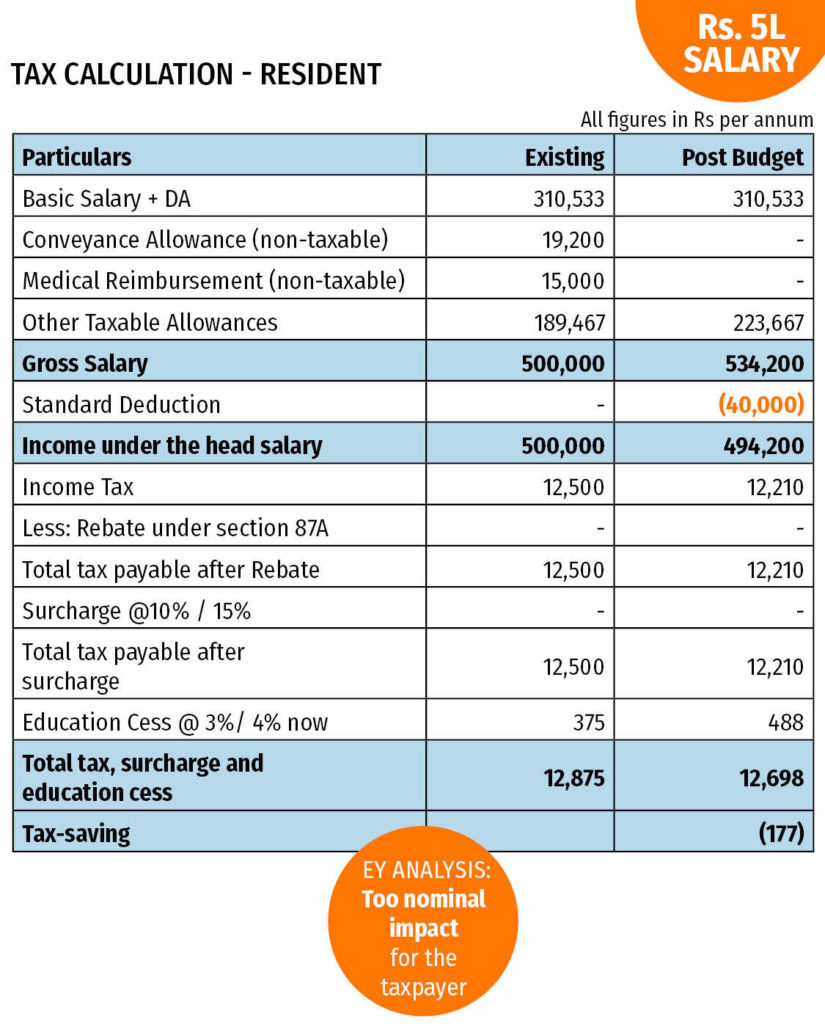

From www.relakhs.com

Rs 50000 Standard Deduction from FY 201920 / AY 202021 Impact Standard Deduction For 2020 The standard deduction reduces a taxpayer’s taxable income. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. It ensures that only households with income above certain thresholds will owe any.. Standard Deduction For 2020.

From standard-deduction.com

What Will The Standard Deduction Be For 2021 Standard Deduction 2021 Standard Deduction For 2020 here are the 2020 standard deductions amounts for each filing status: the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. There is an additional standard deduction of $1,300 for. the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. It. Standard Deduction For 2020.

From standard-deduction.com

2021 Standard Deduction Over 65 Standard Deduction 2021 Standard Deduction For 2020 It ensures that only households with income above certain thresholds will owe any. There is an additional standard deduction of $1,300 for. the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the. Standard Deduction For 2020.

From www.cnbc.com

The 2020 standard deduction amounts Standard Deduction For 2020 the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. for single taxpayers and married individuals filing separately, the standard deduction rises to $12,400 in for 2020, up $200, and. The standard deduction reduces a taxpayer’s taxable income. the standard deduction is the amount taxpayers can subtract from their. Standard Deduction For 2020.

From financegourmet.com

IRS Standard Deduction 2021 Finance Gourmet Standard Deduction For 2020 the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. the table below shows the levels in 2020 for all income tax brackets, the personal exemption, and the standard. It ensures that only households with income above certain thresholds will owe any. The standard deduction reduces a taxpayer’s taxable income.. Standard Deduction For 2020.

From standard-deduction.com

Standard Home Office Deduction 2020 Standard Deduction 2021 Standard Deduction For 2020 There is an additional standard deduction of $1,300 for. the 2020 federal income tax brackets on ordinary income: 10% tax rate up to $9,875 for singles, up to $19,750 for joint filers, 12% tax rate up to $40,125. the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. for. Standard Deduction For 2020.

From standard-deduction.com

Can You Claim Standard Deduction And Itemized/page/2 Standard Standard Deduction For 2020 There is an additional standard deduction of $1,300 for. the 2020 federal income tax brackets on ordinary income: the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. for single taxpayers and married individuals filing separately, the standard deduction rises to $12,400 in for 2020, up $200, and. . Standard Deduction For 2020.

From www.youtube.com

Standard Deduction vs. Itemizing in 2022 YouTube Standard Deduction For 2020 The standard deduction reduces a taxpayer’s taxable income. It ensures that only households with income above certain thresholds will owe any. 10% tax rate up to $9,875 for singles, up to $19,750 for joint filers, 12% tax rate up to $40,125. the 2020 federal income tax brackets on ordinary income: the table below shows the levels in 2020. Standard Deduction For 2020.

From giolwzmux.blob.core.windows.net

Standard Deduction 2022 Vs 2021 at Frank Witcher blog Standard Deduction For 2020 the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. It ensures that only households with income above certain thresholds will owe any. here are the 2020 standard deductions amounts for each filing status: the standard deduction is a specific dollar amount that reduces the amount of income on. Standard Deduction For 2020.

From standard-deduction.com

Standard Deduction In New Budget 2020 Standard Deduction 2021 Standard Deduction For 2020 the standard deduction is the amount taxpayers can subtract from their income if they don’t break out, or. the 2020 federal income tax brackets on ordinary income: The standard deduction reduces a taxpayer’s taxable income. It ensures that only households with income above certain thresholds will owe any. 10% tax rate up to $9,875 for singles, up to. Standard Deduction For 2020.